The global Recommendation Engine for Financial Services market has registered US$ 344.2 million in 2020, and projected to reach at US$ 4073.5 million by 2027, growing at a CAGR of 36.8% during 2021-2027. Recommendation engine using AI helps systems to analyze, learn and adapt new data which is further processed without human intervention. Financial industry has a large set of customers for which general applications or traditional product search engines may not be efficient in terms of providing accurate results. To analyze and process such large data the system needs to use Artificial intelligence, especially machine learning. The recommendation engine uses different algorithms which are designed in such a manner that will help customers to select the financial products that will provide the best value proposition.

Financial Industries are adopting AI in their fields by using their large set of customer data to provide its customer with customized experiences and tailored services. Several financial companies have their respective algorithms to provide the best possible recommendation engine for their customers. However, this concept is relatively new and there are continuous upgrades in the algorithms so as to provide the best customer experience. Moreover, financial data is large and complex data that is continuously changing. Also, the existing patterns of the data may get changed which the algorithm has to take into account. Moreover, with the inclusion of more financial products and services the technology/ the algorithm also has to take these new products into consideration. Thus, there will be continuous growth in this market due to ever-changing demands in the financial industry.

Digitalization is increasing rapidly across the globe. Moreover, the adoption of digitalization is higher in countries Like China, India, and Indonesia which happen to have the highest population respectively. The rise in digitalization is also helping to enhance financial literacy, financial institutions have become aware of the importance of digitization and promoting their products on all types of online platforms. Digitalization has helped financial institutions reach common people through which the awareness about financial products has been increased across various financial products platforms. Users have become more aware of banking, stock trading, mortgages, insurances, cryptocurrency platforms, and other finance platforms. Besides this, recommendation engines allow user-friendly browsing and show the products or information to the customer as per the previous search. In addition, mobile phone ownership is rapidly contributing to financial products growth and prompting several financial institution websites to embrace recommendation engines. Increase in digitization is resulting in the growth of financial literacy which is further accelerating the growth of this market indirectly.

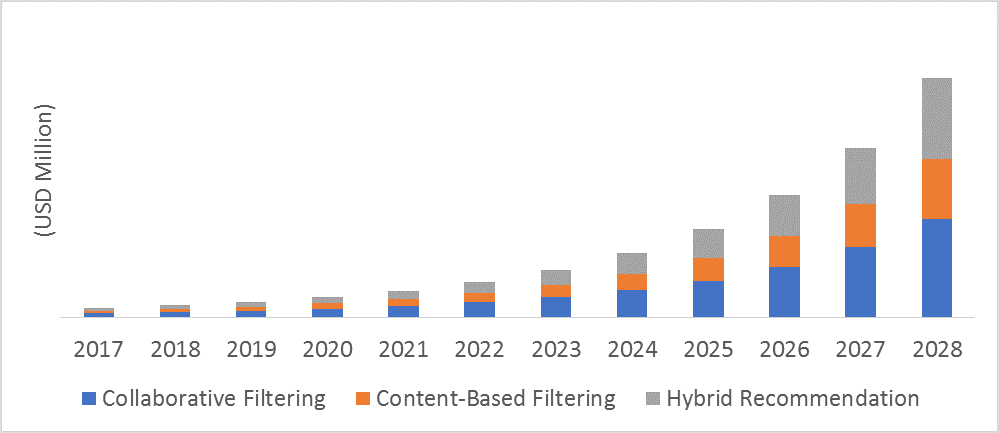

Based on product type, the global market can be segmented into collaborative filtering, content-based filtering and hybrid recommendation. The collaborative filtering is anticipated to be the dominant segment throughout the forecast period. Collaborative filters predict personal preferences of buyers by tracking their searches, likes and dislikes for products. They also track the behavior of their peers who have similar personal demographics. The collected information is then connected to a database that stores data related to preferences of another set of buyers to look for matches and predict purchasing behavior

By deployment model, the global market has been categorized into on-premises and cloud based. The on-premises segment is expected to be the dominant segment throughout the forecast period. Financial industry across the globe is highly regulated industry. For On-premise deployment the company has to have its own hardware, software licenses, security policies and skilled workforce. However, on-premise applications are reliable, secure, and allow enterprises to maintain a level of control that the cloud often cannot.

By technology, the global market has been categorized into machine learning & deep learning, natural language processing and cloud based. The machine learning & deep learning segment is expected to be the dominant segment throughout the forecast period. Machine learning algorithms study the pattern from the available data, group them, classify them, and form groups or clusters, etc. When new data comes in, it thus easily identifies the cluster it belongs to. In terms of recommendation engine, it first captures the past behavior of users who share similar preferences and recommends products that the users are likely to buy. Based on algorithms and recommends the most relevant items to users.

North America is the largest market for the recommendation engine for financial services market. North American financial institutions are digitalizing and adopting artificial intelligence, machine learning, recommendation engine and other advanced technologies. The U.S has more than 70% of the market share in this region. The presence of top banks and tech giant firms has resulted in the growth in this region. American Express has built its own recommendation engine for obtaining new customers and increase sales.

|

Attribute |

Details |

|

Study Period |

2017-2028 |

|

Base Year |

2020 |

|

Forecast Period |

2021-2028 |

|

Unit |

US$ Mn |

|

By Product Type |

|

|

By Deployment Model |

|

|

By Technology |

|

|

By Region |

|

To ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers

A faster and efficient way to cater to the needs with continuous iteration

Focus on Data Accuracy & Reliability

75+ Clients in Fortune 500

All your transactions are secured end-to-end, ensuring a satisfactory purchase

Ensure the best and affordable pricing