The condition monitoring equipment market is a critical segment of the industrial IoT and predictive maintenance ecosystem, This growth is driven by Industry 4.0 adoption, rising demand for downtime reduction in sectors like manufacturing, oil & gas, power generation, and automotive, and advancements in AI, vibration analysis, and wireless sensors. Condition monitoring tools encompassing vibration analyzers, ultrasonic detectors, thermal imagers, oil analyzers, and integrated software platforms enable real-time asset health assessment, preventing failures and optimizing operations.

This report highlights the top global companies leading this market, based on market share, innovation, and revenue from condition monitoring solutions. Each overview includes company profile, key products, strengths, and market positioning. Following that, we explore key suppliers and manufacturing ecosystems, emphasizing supply chain dynamics.

1. Emerson Electric Co. (USA)

Emerson, a $15B+ revenue industrial automation giant, commands ~12% market share in condition monitoring. Founded in 1890 and headquartered in Ferguson, Missouri, it serves 75% of Fortune 500 manufacturers. Its AMS Suite and Plantweb platforms integrate vibration, acoustic, and infrared monitoring with AI-driven analytics for predictive maintenance. Strengths: Seamless integration with DeltaV DCS systems; strong in oil & gas (e.g., 80% of global refineries). Recent innovation: AMS 6500 Machinery Health Monitor, reducing unplanned downtime by 30%. Global footprint: 140+ countries, 85,000 employees.

2. SKF Group (Sweden)

SKF, the world's largest bearing manufacturer ($9B revenue), holds ~10% share, leveraging its core expertise in rotating equipment. Established in 1907 in Gothenburg, SKF's condition monitoring portfolio includes the IMx-8 multichannel system and Enlight ProCollect app for wireless vibration data collection. Strengths: End-to-end solutions from sensors to cloud analytics; dominant in automotive (50% of EV bearing market) and renewables. Highlight: SKF's AxCount predicts failures 6-12 months ahead via machine learning. Operations span 130 countries, 40,000 employees, with R&D hubs in the US and China.

3. General Electric (GE Vernova) (USA)

GE Vernova, spun off in 2024 with $35B revenue, leads with ~9% share, focusing on energy-intensive industries. Headquartered in Cambridge, Massachusetts (roots in 1892), its Bently Nevada line offers 3500 Series monitors for rotor dynamics and gas turbines. Strengths: High-reliability systems for power plants (monitoring 60% of global turbines); integration with Predix platform for digital twins. Innovation: System 1 software, using edge AI for anomaly detection in 1ms. Presence: 100+ countries, 80,000 employees post-spin.

4. Honeywell International Inc. (USA)

Honeywell, a diversified tech conglomerate ($37B revenue), captures ~8% share through its Process Solutions division. Founded 1906 in Morris Plains, New Jersey, it provides UniTrend APM and Versatilis ultrasonic tools for asset performance management. Strengths: Robust in aerospace and chemicals; scalable for SMEs via cloud-based Uniformance. Key product: Experion PKS integrates monitoring with SCADA, cutting maintenance costs 25%. Global reach: 70 countries, 95,000 employees, with manufacturing in Mexico and India.

5. Fluke Corporation (Fortive) (USA)

Fluke, under Fortive ($6.5B revenue), specializes in portable test tools with ~7% share. Acquired by Danaher in 1998 and spun in 2016, headquartered in Everett, Washington, its 810 Vibration Tester and Ti480 PRO thermal camera dominate field diagnostics. Strengths: User-friendly, rugged devices for technicians; strong in electrical and HVAC sectors. Innovation: Connect app for real-time data sharing, boosting uptime 20%. Footprint: 50+ countries, 10,000 employees, assembly in China.

6. Brüel & Kjær (HBK - HBM Hottinger Brüel & Kjær) (Denmark)

HBK, a $1.2B sensor specialist post-2023 merger, holds ~6% share. Founded 1942 in Nærum, its VIBROPORT and PULSE analyzers excel in noise, vibration, and harshness (NVH) testing. Strengths: Precision for automotive R&D (e.g., Tesla partnerships); modular software for custom setups. Highlight: QuantumX DAQ system handles 100kHz sampling. Operations: 50 countries, 5,000 employees, production in Germany.

7. Schneider Electric SE (France)

Schneider, a $38B energy management leader, claims ~5% share via EcoStruxure. Established 1836 in Rueil-Malmaison, its PowerLogic and Uptime solutions monitor electrical assets with IoT edge devices. Strengths: Sustainability focus (net-zero by 2025); integrated with AVEVA for IIoT. Product: EcoStruxure Machine Advisor reduces failures 40%. Global: 100+ countries, 150,000 employees, fabs in Vietnam.

8. Siemens AG (Germany)

Siemens, a $80B engineering behemoth, has ~5% share through MindSphere. Founded 1847 in Munich, its SIMATIC SITRAIN and S7-1500 PLCs embed vibration monitoring for discrete manufacturing. Strengths: Digital twin tech for factories; strong in Europe (40% market). Innovation: Senseye Predictive Maintenance, acquired 2019, uses AI on 1M+ assets. Reach: 200 countries, 300,000 employees, plants in India.

9. ABB Ltd. (Switzerland)

ABB, a $32B electrification firm, secures ~4% share with Ability platform. Originating 1988 from ASEA-BBC merger in Zurich, its 3BSE069 offers wireless sensors for motors. Strengths: Robotics integration; marine and mining dominance. Key: Smart Sensor for pumps, extending life 50%. Presence: 100 countries, 105,000 employees, manufacturing in Sweden.

10. Rockwell Automation Inc. (USA)

Rockwell, a $9B industrial automation player, rounds out with ~4% share. Founded 1903 in Milwaukee, its FactoryTalk Analytics monitors via Pavilion8 software. Strengths: MES compatibility for food & bev; FactoryTalk InnovationSuite for edge AI. Highlight: Emulate3D simulates failures pre-deployment. Global: 80 countries, 29,000 employees, assembly in Mexico.

These leaders collectively hold 60%+ market share, emphasizing integrated, AI-enhanced systems over standalone hardware. North America dominates (35% revenue), followed by Europe (30%) and Asia-Pacific (25%), with China emerging via local players like Beijing SDIC.

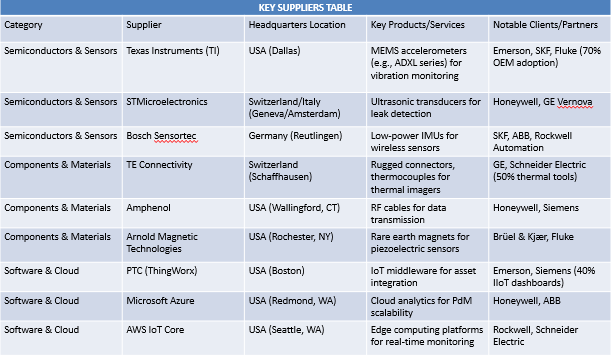

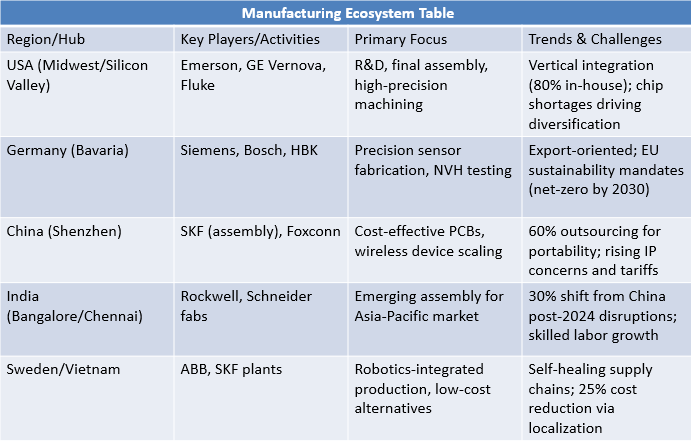

The supply chain for condition monitoring equipment relies on specialized providers for components, sensors, and software, with manufacturing concentrated in key global hubs. Below is a comprehensive table summarizing major suppliers by category, including their locations, key offerings, and notable clients/partners. Following that, a separate table outlines primary manufacturing ecosystems and trends.

This ecosystem supports ~$3.5B in annual market value, with suppliers enabling AI-enhanced innovations. Vertical integration by leaders like SKF reduces lead times by 40%, while global shifts address geopolitical risks.

For in-depth details, visit our research report: https://www.eternityinsights.com/report/condition-monitoring-equipment-market

To ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers

A faster and efficient way to cater to the needs with continuous iteration